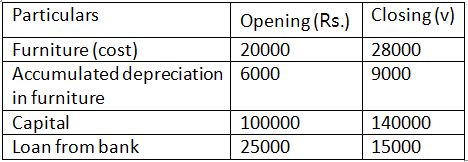

Q.8) Calculate cash flow from investing activities

- -582500

- -572500

- -592500.0

- -562500

This is Accountancy Class 12 Cash Flow Statement CBSE Questions & Answers. There are 15 questions in this test with each question having around four answer choices.

< Go to Homepage